| The price of crude oil today is not made according to any traditional relation of supply to demand. It’s controlled by an elaborate financial market system as well as by the four major Anglo-American oil companies. As much as 60% of today’s crude oil price is pure speculation driven by large trader banks and hedge funds. It has nothing to do with the convenient myths of Peak Oil. It has to do with control of oil and its price. How? First, the crucial role of the international oil exchanges in London and New York is crucial to the game. Nymex in New York and the ICE Futures in London today control global benchmark oil prices which in turn set most of the freely traded oil cargo. They do so via oil futures contracts on two grades of crude oil—West Texas Intermediate and North Sea Brent. A third rather new oil exchange, the Dubai Mercantile Exchange (DME), trading Dubai crude, is more or less a daughter of Nymex, with Nymex President, James Newsome, sitting on the board of DME and most key personnel British or American citizens. Brent is used in spot and long-term contracts to value as much of crude oil produced in global oil markets each day. The Brent price is published by a private oil industry publication, Platt’s. Major oil producers including Russia and Nigeria use Brent as a benchmark for pricing the crude they produce. Brent is a key crude blend for the European market and, to some extent, for Asia. WTI has historically been more of a US crude oil basket. Not only is it used as the basis for US-traded oil futures, but it's also a key benchmark for US production.

‘The tail that wags the dog’

All this is well and official. But how today’s oil prices are really determined is done by a process so opaque only a handful of major oil trading banks such as Goldman Sachs or Morgan Stanley have any idea who is buying and who selling oil futures or derivative contracts that set physical oil prices in this strange new world of “paper oil.” With the development of unregulated international derivatives trading in oil futures over the past decade or more, the way has opened for the present speculative bubble in oil prices. Since the advent of oil futures trading and the two major London and New York oil futures contracts, control of oil prices has left OPEC and gone to Wall Street. It is a classic case of the “tail that wags the dog.” A June 2006 US Senate Permanent Subcommittee on Investigations report on “The Role of Market Speculation in rising oil and gas prices,” noted, “…there is substantial evidence supporting the conclusion that the large amount of speculation in the current market has significantly increased prices.” What the Senate committee staff documented in the report was a gaping loophole in US Government regulation of oil derivatives trading so huge a herd of elephants could walk through it. That seems precisely what they have been doing in ramping oil prices through the roof in recent months. The Senate report was ignored in the media and in the Congress. The report pointed out that the Commodity Futures Trading Trading Commission, a financial futures regulator, had been mandated by Congress to ensure that prices on the futures market reflect the laws of supply and demand rather than manipulative practices or excessive speculation. The US Commodity Exchange Act (CEA) states, “Excessive speculation in any commodity under contracts of sale of such commodity for future delivery . . . causing sudden or unreasonable fluctuations or unwarranted changes in the price of such commodity, is an undue and unnecessary burden on interstate commerce in such commodity.” Further, the CEA directs the CFTC to establish such trading limits “as the Commission finds are necessary to diminish, eliminate, or prevent such burden.” Where is the CFTC now that we need such limits? They seem to have deliberately walked away from their mandated oversight responsibilities in the world’s most important traded commodity, oil. Enron has the last laugh… As that US Senate report noted: “Until recently, US energy futures were traded exclusively on regulated exchanges within the United States, like the NYMEX, which are subject to extensive oversight by the CFTC, including ongoing monitoring to detect and prevent price manipulation or fraud. In recent years, however, there has been a tremendous growth in the trading of contracts that look and are structured just like futures contracts, but which are traded on unregulated OTC electronic markets. Because of their similarity to futures contracts they are often called “futures look-alikes.” The only practical difference between futures look-alike contracts and futures contracts is that the look-alikes are traded in unregulated markets whereas futures are traded on regulated exchanges. The trading of energy commodities by large firms on OTC electronic exchanges was exempted from CFTC oversight by a provision inserted at the behest of Enron and other large energy traders into the Commodity Futures Modernization Act of 2000 in the waning hours of the 106th Congress. The impact on market oversight has been substantial. NYMEX traders, for example, are required to keep records of all trades and report large trades to the CFTC. These Large Trader Reports, together with daily trading data providing price and volume information, are the CFTC’s primary tools to gauge the extent of speculation in the markets and to detect, prevent, and prosecute price manipulation. CFTC Chairman Reuben Jeffrey recently stated: “The Commission’s Large Trader information system is one of the cornerstones of our surveillance program and enables detection of concentrated and coordinated positions that might be used by one or more traders to attempt manipulation.” In contrast to trades conducted on the NYMEX, traders on unregulated OTC electronic exchanges are not required to keep records or file Large Trader Reports with the CFTC, and these trades are exempt from routine CFTC oversight. In contrast to trades conducted on regulated futures exchanges, there is no limit on the number of contracts a speculator may hold on an unregulated OTC electronic exchange, no monitoring of trading by the exchange itself, and no reporting of the amount of outstanding contracts (“open interest”) at the end of each day.” 1 Then, apparently to make sure the way was opened really wide to potential market oil price manipulation, in January 2006, the Bush Administration’s CFTC permitted the Intercontinental Exchange (ICE), the leading operator of electronic energy exchanges, to use its trading terminals in the United States for the trading of US crude oil futures on the ICE futures exchange in London – called “ICE Futures.” Previously, the ICE Futures exchange in London had traded only in European energy commodities – Brent crude oil and United Kingdom natural gas. As a United Kingdom futures market, the ICE Futures exchange is regulated solely by the UK Financial Services Authority. In 1999, the London exchange obtained the CFTC’s permission to install computer terminals in the United States to permit traders in New York and other US cities to trade European energy commodities through the ICE exchange. The CFTC opens the door Then, in January 2006, ICE Futures in London began trading a futures contract for West Texas Intermediate (WTI) crude oil, a type of crude oil that is produced and delivered in the United States. ICE Futures also notified the CFTC that it would be permitting traders in the United States to use ICE terminals in the United States to trade its new WTI contract on the ICE Futures London exchange. ICE Futures as well allowed traders in the United States to trade US gasoline and heating oil futures on the ICE Futures exchange in London. Despite the use by US traders of trading terminals within the United States to trade US oil, gasoline, and heating oil futures contracts, the CFTC has until today refused to assert any jurisdiction over the trading of these contracts.

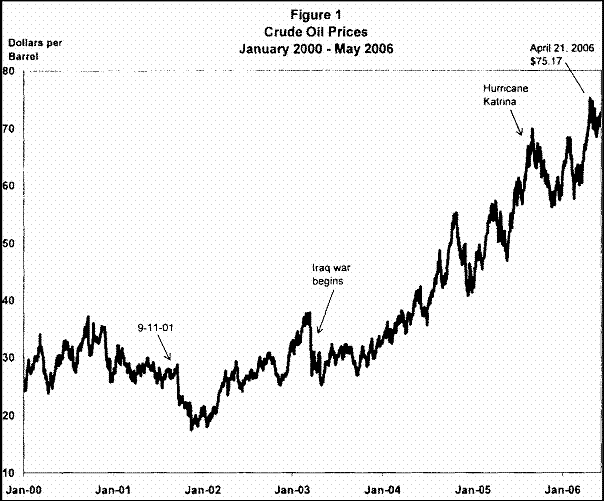

Persons within the United States seeking to trade key US energy commodities – US crude oil, gasoline, and heating oil futures – are able to avoid all US market oversight or reporting requirements by routing their trades through the ICE Futures exchange in London instead of the NYMEX in New York. Is that not elegant? The US Government energy futures regulator, CFTC opened the way to the present unregulated and highly opaque oil futures speculation. It may just be coincidence that the present CEO of NYMEX, James Newsome, who also sits on the Dubai Exchange, is a former chairman of the US CFTC. In Washington doors revolve quite smoothly between private and public posts. A glance at the price for Brent and WTI futures prices since January 2006 indicates the remarkable correlation between skyrocketing oil prices and the unregulated trade in ICE oil futures in US markets. Keep in mind that ICE Futures in London is owned and controlled by a USA company based in Atlanta Georgia. In January 2006 when the CFTC allowed the ICE Futures the gaping exception, oil prices were trading in the range of $59-60 a barrel. Today some two years later we see prices tapping $120 and trend upwards. This is not an OPEC problem, it is a US Government regulatory problem of malign neglect. By not requiring the ICE to file daily reports of large trades of energy commodities, it is not able to detect and deter price manipulation. As the Senate report noted, “The CFTC's ability to detect and deter energy price manipulation is suffering from critical information gaps, because traders on OTC electronic exchanges and the London ICE Futures are currently exempt from CFTC reporting requirements. Large trader reporting is also essential to analyze the effect of speculation on energy prices.” The report added, “ICE's filings with the Securities and Exchange Commission and other evidence indicate that its over-the-counter electronic exchange performs a price discovery function -- and thereby affects US energy prices -- in the cash market for the energy commodities traded on that exchange.” Hedge Funds and Banks driving oil prices In the most recent sustained run-up in energy prices, large financial institutions, hedge funds, pension funds, and other investors have been pouring billions of dollars into the energy commodities markets to try to take advantage of price changes or hedge against them. Most of this additional investment has not come from producers or consumers of these commodities, but from speculators seeking to take advantage of these price changes. The CFTC defines a speculator as a person who “does not produce or use the commodity, but risks his or her own capital trading futures in that commodity in hopes of making a profit on price changes.” The large purchases of crude oil futures contracts by speculators have, in effect, created an additional demand for oil, driving up the price of oil for future delivery in the same manner that additional demand for contracts for the delivery of a physical barrel today drives up the price for oil on the spot market. As far as the market is concerned, the demand for a barrel of oil that results from the purchase of a futures contract by a speculator is just as real as the demand for a barrel that results from the purchase of a futures contract by a refiner or other user of petroleum. Perhaps 60% of oil prices today pure speculation Goldman Sachs and Morgan Stanley today are the two leading energy trading firms in the United States. Citigroup and JP Morgan Chase are major players and fund numerous hedge funds as well who speculate. In June 2006, oil traded in futures markets at some $60 a barrel and the Senate investigation estimated that some $25 of that was due to pure financial speculation. One analyst estimated in August 2005 that US oil inventory levels suggested WTI crude prices should be around $25 a barrel, and not $60. That would mean today that at least $50 to $60 or more of today’s $115 a barrel price is due to pure hedge fund and financial institution speculation. However, given the unchanged equilibrium in global oil supply and demand over recent months amid the explosive rise in oil futures prices traded on Nymex and ICE exchanges in New York and London it is more likely that as much as 60% of the today oil price is pure speculation. No one knows officially except the tiny handful of energy trading banks in New York and London and they certainly aren’t talking. By purchasing large numbers of futures contracts, and thereby pushing up futures prices to even higher levels than current prices, speculators have provided a financial incentive for oil companies to buy even more oil and place it in storage. A refiner will purchase extra oil today, even if it costs $115 per barrel, if the futures price is even higher. As a result, over the past two years crude oil inventories have been steadily growing, resulting in US crude oil inventories that are now higher than at any time in the previous eight years. The large influx of speculative investment into oil futures has led to a situation where we have both high supplies of crude oil and high crude oil prices. Compelling evidence also suggests that the oft-cited geopolitical, economic, and natural factors do not explain the recent rise in energy prices can be seen in the actual data on crude oil supply and demand. Although demand has significantly increased over the past few years, so have supplies. Over the past couple of years global crude oil production has increased along with the increases in demand; in fact, during this period global supplies have exceeded demand, according to the US Department of Energy. The US Department of Energy’s Energy Information Administration (EIA) recently forecast that in the next few years global surplus production capacity will continue to grow to between 3 and 5 million barrels per day by 2010, thereby “substantially thickening the surplus capacity cushion.” Dollar and oil link A common speculation strategy amid a declining USA economy and a falling US dollar is for speculators and ordinary investment funds desperate for more profitable investments amid the US securitization disaster, to take futures positions selling the dollar “short” and oil “long.” For huge US or EU pension funds or banks desperate to get profits following the collapse in earnings since August 2007 and the US real estate crisis, oil is one of the best ways to get huge speculative gains. The backdrop that supports the current oil price bubble is continued unrest in the Middle East, in Sudan, in Venezuela and Pakistan and firm oil demand in China and most of the world outside the US. Speculators trade on rumor, not fact. In turn, once major oil companies and refiners in North America and EU countries begin to hoard oil, supplies appear even tighter lending background support to present prices. Because the over-the-counter (OTC) and London ICE Futures energy markets are unregulated, there are no precise or reliable figures as to the total dollar value of recent spending on investments in energy commodities, but the estimates are consistently in the range of tens of billions of dollars. The increased speculative interest in commodities is also seen in the increasing popularity of commodity index funds, which are funds whose price is tied to the price of a basket of various commodity futures. Goldman Sachs estimates that pension funds and mutual funds have invested a total of approximately $85 billion in commodity index funds, and that investments in its own index, the Goldman Sachs Commodity Index (GSCI), has tripled over the past few years. Notable is the fact that the US Treasury Secretary, Henry Paulson, is former Chairman of Goldman Sachs. As detailed in an earlier article, a conservative calculation is that at least 60% of today’s $128 per barrel price of crude oil comes from unregulated futures speculation by hedge funds, banks and financial groups using the London ICE Futures and New York NYMEX futures exchanges and uncontrolled inter-bank or Over-The-Counter trading to avoid scrutiny. US margin rules of the government’s Commodity Futures Trading Commission allow speculators to buy a crude oil futures contract on the Nymex, by having to pay only 6% of the value of the contract. At today's price of $128 per barrel, that means a futures trader only has to put up about $8 for every barrel. He borrows the other $120. This extreme “leverage” of 16 to 1 helps drive prices to wildly unrealistic levels and offset bank losses in sub-prime and other disasters at the expense of the overall population. The hoax of Peak Oil—namely the argument that the oil production has hit the point where more than half all reserves have been used and the world is on the downslope of oil at cheap price and abundant quantity—has enabled this costly fraud to continue since the invasion of Iraq in 2003 with the help of key banks, oil traders and big oil majors. Washington is trying to shift blame, as always, to Arab OPEC producers. The problem is not a lack of crude oil supply. In fact the world is in over-supply now. Yet the price climbs relentlessly higher. Why? The answer lies in what are clearly deliberate US government policies that permit the unbridled oil price manipulations. World Oil Demand Flat, Prices Boom… The chief market strategist for one of the world’s leading oil industry banks, David Kelly, of J.P. Morgan Funds, recently admitted something telling to the Washington Post, “One of the things I think is very important to realize is that the growth in the world oil consumption is not that strong." One of the stories used to support the oil futures speculators is the allegation that China’s oil import thirst is exploding out of control, driving shortages in the supply-demand equilibrium. The facts do not support the China demand thesis however. The US Government’s Energy Information Administration (EIA) in its most recent monthly Short Term Energy Outlook report, concluded that US oil demand is expected to decline by 190,000 b/d in 2008. That is mainly owing to the deepening economic recession. Chinese consumption, the EIA says, far from exploding, is expected to rise this year by only 400,000 barrels a day. That is hardly the "surging oil demand" blamed on China in the media. Last year China imported 3.2 million barrels per day, and its estimated usage was around 7 million b/d total. The US, by contrast, consumes around 20.7 million b/d. That means the key oil consuming nation, the USA, is experiencing a significant drop in demand. China, which consumes only a third of the oil the US does, will see a minor rise in import demand compared with the total daily world oil output of some 84 million barrels, less than half of a percent of the total demand. The Organization of the Petroleum Exporting Countries (OPEC) has its 2008 global oil demand growth forecast unchanged at 1.2 mm bpd, as slowing economic growth in the industrialised world is offset by slightly growing consumption in developing nations. OPEC predicts global oil demand in 2008 will average 87 million bpd -- largely unchanged from its previous estimate. Demand from China, the Middle East, India, and Latin America -- is forecast to be stronger but the EU and North American demand will be lower. So the world’s largest oil consumer faces a sharp decline in consumption, a decline that will worsen as the housing and related economic effects of the US securitization crisis in finance de-leverages. The price in normal open or transparent markets would presumably be falling not rising. No supply crisis justifies the way the world's oil is being priced today. Big new oil fields coming online Not only is there no supply crisis to justify such a price bubble. There are several giant new oil fields due to begin production over the course of 2008 to further add to supply. The world’s single largest oil producer, Saudi Arabia is finalizing plans to boost drilling activity by a third and increase investments by 40 %. Saudi Aramco's plan, which runs from 2009 to 2013, is expected to be approved by the company's board and the Oil Ministry this month. The Kingdom is in the midst of a $ 50 billion oil production expansion plan to meet growing demand in Asia and other emerging markets. The Kingdom is expected to boost its pumping capacity to a total of 12.5 mm bpd by next year, up about 11 % from current capacity of 11.3 mm bpd. In April this year Saudi Arabia's Khursaniyah oilfield began pumping and will soon add another 500,000 bpd to world oil supply of high grade Arabian Light crude. As well, another Saudi expansion project, the Khurais oilfield development, is the largest of Saudi Aramco projects that will boost the production capacity of Saudi oilfields from 11.3 million bpd to 12.5 million bpd by 2009. Khurais is planned to add another 1.2 million bpd of high-quality Arabian light crude to Saudi Arabia's export capacity. Brazil’s Petrobras is in the early phase of exploiting what it estimates are newly confirmed oil reserves offshore in its Tupi field that could be as great or greater than the North Sea. Petrobras, says the new ultra-deep Tupi field could hold as much as 8 billion barrels of recoverable light crude. When online in a few years it is expected to put Brazil among the world's "top 10" oil producers, between those of Nigeria and those of Venezuela. In the United States, aside from rumors that the big oil companies have been deliberately sitting on vast new reserves in Alaska for fear that the prices of recent years would plunge on over-supply, the US Geological Survey (USGS) recently issued a report that confirmed major new oil reserves in an area called the Bakken, which stretches across North Dakota, Montana and south-eastern Saskatchewan. The USGS estimates up to 3.65 billion barrels of oil in the Bakken. These are just several confirmations of large new oil reserves to be exploited. Iraq, where the Anglo-American Big Four oil majors are salivating to get their hands on the unexplored fields, is believed to hold oil reserves second only to Saudi Arabia. Much of the world has yet to be explored for oil. At prices above $60 a barrel huge new potentials become economic. The major problem faced by Big Oil is not finding replacement oil but keeping the lid on world oil finds in order to maintain present exorbitant prices. Here they have some help from Wall Street banks and the two major oil trade exchanges—NYMEX and London-Atlanta’s ICE and ICE Futures. Then why do prices still rise? There is growing evidence that the recent speculative bubble in oil which has gone asymptotic since January is about to pop. Late last month in Dallas Texas, according to one participant, the American Association of Petroleum Geologists held its annual conference where all the major oil executives and geologists were present. According to one participant, knowledgeable oil industry CEOs reached the consensus that "oil prices will likely soon drop dramatically and the long-term price increases will be in natural gas." Just a few days earlier, Lehman Brothers, a Wall Street investment bank had said that the current oil price bubble was coming to an end. Michael Waldron, the bank's chief oil strategist, was quoted in Britain's Daily Telegraph on Apr. 24 saying, "Oil supply is outpacing demand growth. Inventories have been building since the beginning of the year.” In the US, stockpiles of oil climbed by almost 12 million barrels in April according to the May 7 EIA monthly report on inventory, up by nearly 33 million barrels since January. At the same time, MasterCard's May 7 US gasoline report showed that gas demand has fallen by 5.8%. And refiners are reducing their refining rates dramatically to adjust to the falling gasoline demand. They are now running at 85% of capacity, down from 89% a year ago, in a season when production is normally 95%. The refiners today are clearly trying to draw down gasoline inventories to bid gasoline prices up. ‘It’s the economy, stupid,’ to paraphrase Bill Clinton’s infamous 1992 election quip to daddy Bush. It’s called economic recession. The May 8 report from Oil Movements, a British company that tracks oil shipments worldwide, shows that oil in transit on the high seas is also quite strong. Almost every category of shipment is running higher than it was a year ago. The report notes that, "In the West, a big share of any oil stock building done this year has happened offshore, out of sight." Some industry insiders say the global oil industry from the activities and stocks of the Big Four to the true state of tanker and storage and liftings, is the most secretive industry in the world with the possible exception of the narcotics trade. Goldman Sachs again in the middle The oil price today, unlike twenty years ago, is determined behind closed doors in the trading rooms of giant financial institutions like Goldman Sachs, Morgan Stanley, JP Morgan Chase, Citigroup, Deutsche Bank or UBS. The key exchange in the game is the London ICE Futures Exchange (formerly the International Petroleum Exchange). ICE Futures is a wholly-owned subsidiary of the Atlanta Georgia International Commodities Exchange. ICE in Atlanta was founded in part by Goldman Sachs which also happens to run the world’s most widely used commodity price index, the GSCI, which is over-weighted to oil prices. As I noted in my earlier article, (‘Perhaps 60% of today’s oil price is pure speculation’), ICE was focus of a recent congressional investigation. It was named both in the Senate's Permanent Subcommittee on Investigations' June 27, 2006, Staff Report and in the House Committee on Energy & Commerce's hearing in December 2007 which looked into unregulated trading in energy futures. Both studies concluded that energy prices' climb to $128 and perhaps beyond is driven by billions of dollars' worth of oil and natural gas futures contracts being placed on the ICE. Through a convenient regulation exception granted by the Bush Administration in January 2006, the ICE Futures trading of US energy futures is not regulated by the Commodities Futures Trading Commission, even though the ICE Futures US oil contracts are traded in ICE affiliates in the USA. And at Enron’s request, the CFTC exempted the Over-the-Counter oil futures trades in 2000. So it is no surprise to see in a May 6 report from Reuters that Goldman Sachs announces oil could in fact be on the verge of another "super spike," possibly taking oil as high as $200 a barrel within the next six to 24 months. That headline, "$200 a barrel!" became the major news story on oil for the next two days. How many gullible lemmings followed behind with their money bets? Arjun Murti, Goldman Sachs' energy strategist, blamed what he called "blistering" (sic) demand from China and the Middle East, combined with his assertion that the Middle East is nearing its maximum ability to produce more oil. Peak Oil mythology again helps Wall Street. The degree of unfounded hype reminds of the kind of self-serving Wall Street hype in 1999-2000 around dot.com stocks or Enron. In 2001 just before the dot.com crash in the NASDAQ, some Wall Street firms were pushing sale to the gullible public of stocks that their companies were quietly dumping. Or they were pushing dubious stocks for companies where their affiliated banks had a financial interest. In short as later came out in Congressional investigations, companies with a vested interest in a certain financial outcome used the media to line their pockets and that of their companies, leaving the public investor holding the bag. It would be interesting for Congress to subpoena the records of the futures positions of Goldman Sachs and a handful of other major energy futures players to see if they are invested to gain from a further rise in oil to $200 or not. Margin rules feed the frenzy Another added turbo-charger to present speculation in oil prices is the margin rule governing what percent of cash a buyer of a futures contract in oil has to put up to bet on a rising oil price (or falling for that matter). The current NYMEX regulation allows a speculator to put up only 6% of the total value of his oil futures contract. That means a risk-taking hedge fund or bank can buy oil futures with a leverage of 16 to 1. We are hit with an endless series of plausible arguments for the high price of oil: A "terrorism risk premium;" “blistering” rise in demand of China and India; unrest in the Nigerian oil region; oil pipelines' blown up in Iraq; possible war with Iran…And above all the hype about Peak Oil. Oil speculator T. Boone Pickens has reportedly raked in a huge profit on oil futures and argues, conveniently that the world is on the cusp of Peak Oil. So does the Houston investment banker and friend of Dick Cheney, Matt Simmons. As the June 2006 US Senate report, The Role of Market Speculation in Rising Oil and Gas Prices, noted, "There's a few hedge fund managers out there who are masters at knowing how to exploit the peak oil theories and hot buttons of supply and demand, and by making bold predictions of shocking price advancements to come, they only add more fuel to the bullish fire in a sort of self-fulfilling prophecy." Will a Democratic Congress act to change the carefully crafted opaque oil futures markets in an election year and risk bursting the bubble? On May 12 House Energy & Commerce Committee stated it will look at this issue into June. The world will be watching. Global Research Associate F. William Engdahl is author of A Century of War: Anglo-American Oil Politics and the New World Order (PlutoPress), and Seeds of Destruction: The Hidden Agenda of Genetic Manipulation. (Global Research, available at www.globalresearch.ca). He may be reached at info@engdahl.oilgeopolitics.net. |